Mortgage Fraud in Oakland County, Michigan

On March 13, 2014, the Office of Inspector General of the Department of Justice issued a report that was critical of the DOJ's efforts in combating mortgage fraud. Follow this link to the Summary Report.

Follow the link for a detailed discussion of Mortgage Fraud-The Perfect Crime?

A few examples of

Questionable Sales in Oakland County, Michigan.

It should be noted that

the examples are limited to Oakland County and a few transactions in Macomb

County.

Thus, it is possible that a buyer (straw buyer) or title company could be

a party to similar transactions outside of Oakland and Macomb County.

In total, I have

developed a spreadsheet with other 100 transactions that total over $100 million

at selling price. All of the information

is from public documents such as Warranty Deeds, mortgages and Sheriff's

Deeds. As I do not have access to closing documents to include HUD-1 and

1003 forms , I

cannot say with certainty that each transaction I have identified is fraudulent.

A number of sales in the same subdivision, all well above market price.

· 3 sales at $500,000.00.

· 2 sales at $491,000.00 and 1 sale at $490,000.00.

· 1 sale at $470,000.00.

· Same title company in 6 of the sales. The title company has an address outside of Oakland County.

· One of the “buyers” purchased 2 of the above homes and one home not in the same subdivision.

·

One "buyer" and or wife purchased 2 of the above homes and 4 other homes not in

the same subdivision.

A

purchase of two homes, one for $1,140,000.00 and one for $2,100,000.00.

Purchases were less than 30 days apart.

A

purchase in June, 2005 for $1,060,000.00 and a sale in August, 2005 for

$2,500,000.00.

Two

purchases in August, 2005 to wife and husband and wife, one purchase for

$2,200,000.00 and one for $2,000,000.00.

Purchase

and sale the same date in January, 2006. Purchase for $965,000.00 and sale

for $2,100,000.00.

Purchase

and sale the same date in June, 2005. Purchase for $1,950,000.00 and sale

for $4,200,000.00.

Purchase for $1,590,000.00 in February, 2005. Sheriff’s Deed in January, 2006 and redemption April, 2006. Sale in April, 2006 for $2,600,000.00.

Nineteen sales of condominiums in Independence Township (Clarkston mailing address) at or near the same selling price with all 19 going to foreclosure. Most sales with 100% financing.

Nine

sales of condominiums on Southfield Road in Birmingham, Michigan, all with

similar sales characteristics and all going to foreclosure. Most sales

with 100% financing.

The victims:

You may be a victim of mortgage fraud if there was a fraudulent sale in your community or more specifically in your subdivision or on your street. Once the fraudulent sale occurred, the home may become vacant, which can lead to a state of disrepair. When the lender foreclosures, this can lead to a decline in market values of nearby homes. When legitimate owners attempt to sell their homes, they might find the current market value of their home is less than the mortgage balance. This can lead to short sales, and spiraling downward prices, coupled with more foreclosures.

Mortgage fraud investigated:

It is my understanding

that if a lender expects fraud, they file a Suspicious Activity Report (“SAR”)

with the FBI. Presumably the FBI would investigate and seek indictments

against those responsible for perpetrating the fraud. The indictments

would be sought by the U.S. Attorney for the Eastern District of Michigan.

It is doubtful that a

lender would report the potential fraud to local or county law enforcement.

Presumably, this is not done because the SAR was directed to the FBI.

Task Forces:

According to Press

Releases and news reports there are currently three mortgage fraud task forces

operating in the area. The Oakland County Clerk/Register Deeds task force

was announced on January 20, 2006. The Multi-Agency

Mortgage Fraud Task Force task

force was announced on October 7, 2008. It was reported that the

Michigan State Police started to form a task force in the fall of 2008 but may

not have been fully operational until early 2009.

According to the Press Release, the Oakland County Prosecutor's Office, the Oakland County Sheriff's Office and the Oakland County Clerk/Register of Deeds are "now working together". "We want them to know if they come to Oakland County they're going to be in big trouble."

The Multi-Agency Mortgage Fraud Task Force included in addition to the U.S. Attorney's office and the FBI numerous agencies and three banks. The FFETF was supposed to include numerous agencies.

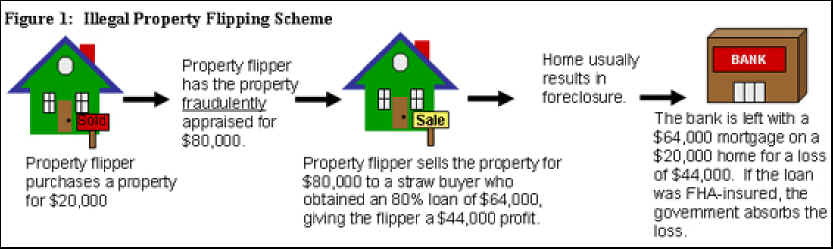

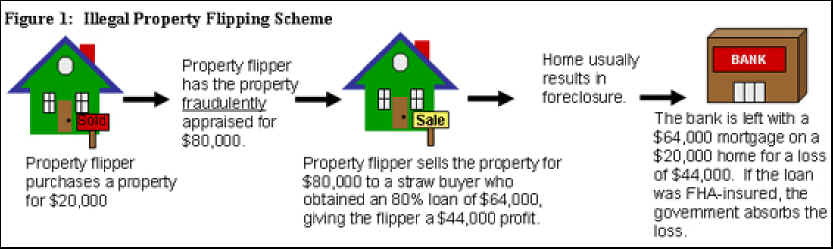

Who might be involved in mortgage fraud?

There could be a number of individuals and or companies. It could be a mortgage broker, a real estate salesperson, an appraiser, a title company, a straw buyer, an employee of a lender, the seller of the property or a number of others.

Other criminal

activities:

Other than the broad

category of mortgage fraud, the illegal activities can include the failure to

report the gain on sale for Federal and State income taxes in the case where the

property is flipped for a substantial gain. Or the activities could

include a series of transactions that involve the use of quit claim deeds where

the fair market value is not properly reported resulting in the avoidance of the

Michigan Transfer Tax.

In a Department of Justice Press Release dated July 8, 2009 a Special Agent in Charge of IRS Criminal Investigation said, "These type of crimes create a significant loss of tax revenue, drive buyers into foreclosure, leave lenders burdened with bad loans and neighborhoods with abandoned and deteriorating properties. IRS CI is committed to pursuing individuals who create such havoc."

Not sure any of the criminals involved in mortgage fraud read the DOJ Press Releases, but it seems some indictments and prosecutions in Oakland County might send a more powerful message.

Contact if mortgage fraud

is suspected:

The FBI has provided a tip line and the number for the Detroit Mortgage Fraud Hotline is 313-237-4530. However, based on my experience do not expect that any action will be taken by the FBI or any law enforcement agency.

Mortgage Fraud—The

Perfect Crime?

Have you been affected by

mortgage fraud? Perhaps you have but didn’t realize it even though

your neighborhood is dotted with vacant homes and all too many “For Sale”

signs. Mortgage fraud impacts home values when lenders foreclose and are

forced to sell the foreclosed property at prices far less than what was once

considered fair market value. Legitimate homeowners may find the market

value of their home to be far less than the original purchase price and well

below the existing mortgage balance. This can lead to short sales, more

unsold homes in an already glutted market, or even foreclosure. A short

sale is when a homeowner sells a home at less than the mortgage balance after

the lender has agreed to take less than the outstanding balance as full

settlement.

What are some possible

characteristics of mortgage fraud? Sales at prices that appear to be far

above the current market value followed closely by foreclosure.

Buyers who purchase a number of properties within a short period of time.

These buyers might be straw buyers where the credit information is fraudulent or

the credit information of a real person is used. Transactions where the

purchase price is equal or close to the inflated values of other properties and

the same title company is used or the warranty deed is drafted by the same

individual. Purchases where the buyer is married but the spouse uses

different names such as a hyphenated last name. This makes it more difficult to

track more than one purchase by the same buyer. Purchases where

there are a number of transactions on or near the same date. This could

include sales using a warranty deed and or a quitclaim deed.

Generally the sales value increases with each transaction. Sales that are

financed with a 100% mortgage to purchase price or two mortgages, one at 80% and

one at 20%, sometimes to the same lender.

Do you believe there has

been any mortgage fraud in Oakland County? Yes, I believe there has

been a considerable amount of fraud in Farmington Hills, Bloomfield Township and

Bloomfield Hills with lesser levels in Birmingham, Rochester, Rochester Hills

and Clarkston.

Do you have definitive

proof that mortgage fraud has been committed? No I cannot state with 100%

certainty as the purchase and sale documents as well as credit information are

considered confidential by the lenders. Essential information would

include the HUD-1 forms where information as to the sale price and the

distribution of proceeds are detailed. Matching these forms would give

some indication as to whether or not the seller was involved in the fraud or

just an unwitting participant.

How did you discover what

you believe to be mortgage fraud? In preparation for an appearance before

the City of Farmington Hills Board of Review, I reviewed sales comparison data

for a particular subdivision. I noted a number of sales at or near the

same selling price. Many of the sales were at the same sales price and

above what appeared to be a normal sales value. In reviewing specific

information, I noted that some of the sales were to the same individuals, the

same title company was used in many instances, mortgages generally totaled 100%

of the purchase price and the lenders had foreclosed through Sheriff’s Deeds

on many of the properties.

Did you report your

suspicions to the authorities? Yes, but unfortunately the City of

Farmington Hills Police Department was not interested unless I brought them

additional information. The individual I spoke with didn’t even

want to sit down and go over the information I had or even obtain a copy of my

spreadsheet for later review. The impression I was left with was the

victim was a mortgage company and mortgage fraud was tough to prove. Had I been

thinking, I would have suggested that banks are the victims in a bank robbery

and these seem to be investigated. I then submitted my initial findings to

the Detroit office of the FBI. I never received any reply.

Did your analysis of

possible mortgage fraud extend beyond your initial review? Yes, I found

that the Oakland County Register of Deeds/ County Clerk had developed an online

service called Fraud Check. This allows anyone to enter the first and last

name of a person to see what documents have been recorded under that name.

I believe the intent is to ensure that your name is not being fraudulently used.

When I entered the names of questionable purchasers in Farmington Hills, I

discovered other purchases, some of which were in other communities, with many

of those going to foreclosure.

Using the information

from Fraud Check, I used another online service that is a pay per use service

with the name landaccess.com. This service allows the user to review

recorded summary information in selected counties. That information includes

information such as Warranty Deeds, Quit Claim Deeds, Mortgages, Discharge of

Mortgages, liens and Sheriff’s Deeds. If further information is required

the actual document can be reviewed and printed for any additional charge.

This information allowed me to determine if there were consistencies with other

transactions such as the buyer, the address used by the buyer, title company and

the individual drafting the document. If the search was by property as

opposed to individual, it allowed me to review other recorded documents on or

near the questionable sale date.

As a further step, I

subscribed to RealtyTrac.com. There is a monthly fee and this service

lists pre-foreclosures, auctions and foreclosures by location such as city or

zip code. If a property had a high sale price in period 2005-2007, with a

current estimated market value considerably less than the sale price, or a high

per square foot price, I used the information from the website as a basis for

further review starting with Fraud Check and then landaccess.com.

As I gathered information

on possible questionable transactions, I continued to send information I had

entered on an Excel spreadsheet to the FBI, first to the Flint office and then

the Troy office. Not being satisfied with the response, I re-contacted the

Farmington Hills Police Department, contacted the Police Chief in Bloomfield

Township, the Special Agent in Charge of the Detroit office of the FBI, the U.S.

Attorney in Detroit and the Assistant Attorney General in charge of the Criminal

Division of the Michigan Attorney General.

As the list of possible

questionable transactions has grown to over 100 separate transactions with

selling prices that range primarily from $500,000.00 to over $4 million and

which total in excess of $100 million, I falsely assumed that at least one law

enforcement agency would be interested in meeting with me to go over the

individual information I had gathered. I have a file folder with information and

copies of pertinent data on each questionable sale.

Farmington Hills

doesn’t believe that there was any fraud, Bloomfield Township says they are

working with the Troy office of the FBI, the U.S. Attorney says they don’t

investigate, only prosecute, and no one at the Michigan AG has ever contacted

me. While I have spoken to individuals at the Flint and Troy office of the

FBI, they cannot reveal any information. They did indicate that much

of the information I sent them was already known to them and that lenders

routinely provide information relating to questionable transactions.

While the FBI, the

Michigan AG and local law enforcement may be reviewing questionable sales

transactions with the intent of prosecuting actions they deem to rise to the

level of mortgage fraud, I suggest that the actions are too little, too late.

If definitive action had been taken early on, I doubt that many of the

transactions on my spreadsheet would have taken place. With few

prosecutions, it must have appeared to be the perfect crime.

Many articles seem to

suggest that mortgage fraud is tough to uncover and difficult to prove. I

don’t agree with that premise. I have proven that it is easy to uncover.

Law enforcement has many tools available to it. If I was able to review

the sales and closing documents for each of the transactions on my spreadsheet,

I could tell at a glance whether further review is necessary. These

documents could easily be obtained using the

subpoena power available to law enforcement. If the problem is manpower,

it seems that a joint task force of local, state and federal law enforcement

should have been formed. Furthermore, fraud should be prosecuted as the review

is complete. It’s not necessary to have a flashy news conference to tell

the Press what a great job is being done. Those legitimate homeowners who

are the real victims of mortgage fraud deserve more.

Can you give some brief

examples of questionable sales that in your opinion deserve further review?

As I said there are over 100 separate transactions but I will summarize a few.

Two sales to the same couple within a one month time span for homes in

Farmington Hills at $500,000.00 each. 100% financing on each, with both

going to foreclosure in less than one year. 9 sales in 2006-2007 using the

same title company that all went to foreclosure, and most involved 100%

financing. A sale at $1,060,000.00 in June, 2005 with a subsequent sale in

August, 2005 for $2.5 million with a subsequent foreclosure. Two purchases

by a single woman (not gender bias, just fact as a number of questionable sales

were to single women) for $1,140,000.00 and $2,100,000.00, within a one month

time span in 2006. Both homes went to foreclosure. A sale of a home

in June, 2005 for $1,950,000.00, then a quitclaim deed to a non-existent LLC,

and then a sale on the same date for $4,200,000.00. The home went into

foreclosure. These are but a few examples of the questionable sales on my

spreadsheet.

If mortgage fraud is tough to prove, are there other avenues that should be pursued? Yes, I suggested to the supervisor in the Troy office of the FBI that the IRS should be brought in. The response was that the IRS has methods to discover unreported income. While that may be factually correct, I doubt that 1099s were issued listing sales proceeds, as required by law, if the transaction was fraudulent to begin with. It’s easy to see that gains of over $1 or $2 million in my previous examples should have been reported for both Federal and State tax purposes. It’s very disappointing that no one from the Michigan AG has ever contacted me. Seems to me the State of Michigan should be interested in ensuring that it collects every tax dollar. I have given some examples to the IRS.

In conclusion, mortgage

fraud may not be the perfect crime but to date it seems little has been done by

law enforcement. I recall a number of years ago that college

football betting rings were seemingly always busted right before or following

the last game on the year. Law enforcement spent the entire season

gathering evidence and announced the millions in illegal betting took place each

week. I never recall an announcement of what the penalties were, if any,

and if any of the millions were ever recovered.

Now that mortgage fraud has hopefully been eliminated or at least subsided on a going forward basis, it’s time for law enforcement to aggressively pursue each and every historical case that involves possible mortgage fraud. While this may be too late to help the legitimate homeowners who are the innocent victims of this fraud, it is inconceivable that law enforcement simply ignore the situation or wait for the next national coordinated press conference.